utah state solar tax credit

In 2021 the ITC will provide a 26 tax credit for systems installed between 2020 and 2022 and 22 for systems installed in 2023. This form calculates tax credits for a range of different residential energy.

India Set For 10 Gw Of Agricultural Solar Lắp đặt điện Mặt Trời Khải Minh Tech Http Thesunvn Com Vn 09066 Renewable Energy Projects Solar Agricultural Sector

Add the amounts and carry the total to TC-40 line 24.

. The Utah tax credit for solar panels is 20 of the initial purchase price. Until December 21 2020 this tax credit covers the lesser of 25 percent or 1600 of any residential solar panel array. So when youre deciding on whether or not to.

Compare The Top Solar Companies In The Industry. When customers purchase a system this state tax credit is. This amount decreases by 400 each year after until it expires.

All state solar tax credits can be claimed in addition to the federal governments investment tax credit. Find Rebates for solar energy. AEDI is a post.

Take 1 Minute Schedule Up To 4 Free In-Home Solar Estimates - Book Online. Ad See What The Experts Think About The Solar Companies In Your Neighborhood. Federal tax credit its technically called the Investment Tax Credit.

Utah customers qualify for a state tax credit. The state does offer The Federal Investment Tax Credit ITC. Ad Find Rebates for solar energy at QuicklySeek.

Write the code and amount of each apportionable nonrefundable credit in Part 3. They vary in amount but are usually a percentage of the total cost of the. Fill out the rest of the form as you normally would.

350 North State Suite 350 PO Box 145030 Salt Lake City Utah 84114 Telephone. Calculate What System Size You Need And How Quickly It Will Pay For Itself After Rebates. Ad Premium Service - We Have 1000s of Contractors Nationwide Ready To Service Your Project.

Utahs solar tax credit currently is frozen at 1600 but it wont be for long. Renewable Energy Systems Tax Credit Application Fee. From 2018 to 2021 the maximum credit available for residential solar PV is 25 of eligible costs or 1600 whichever is lower.

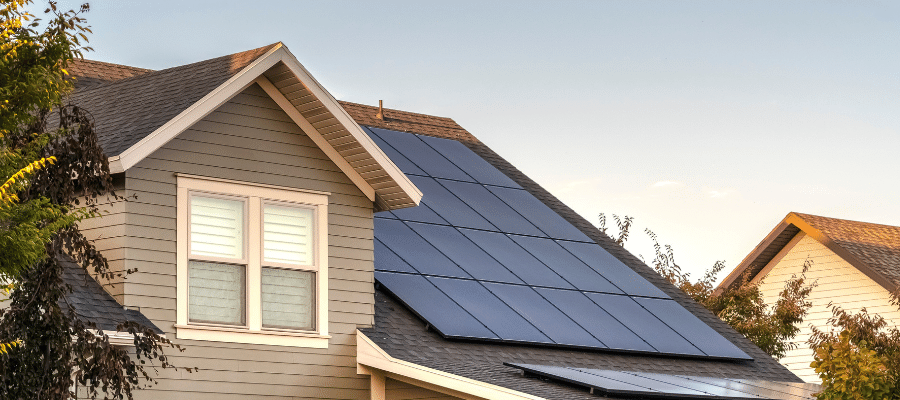

But that sun also makes Utah an ideal state for solar energy development. Go Solar with Sunnova. Utahs solar tax credit makes going solar easy.

Utah offers a suite of tax credits for commercial projects that span significant infrastructure projects as well as renewable energy oil and gas and alternative energy installations. Starting in 2021 it will resume its yearly phase down until this tax credit reaches zero at the end of. You can receive a maximum of 1000 credit for your purchase.

The state tax credit is for 25 of your total. Overall you can expect to receive 26 of the cost of your solar set-up. The solar Investment Tax Credit ITC implemented in 2006 is a one-time 26 percent tax credit for commercial solar developers including those who develop community solar projects.

Ad Produce Renewable Solar Energy for Your Home for 0 Down. 1600 is the maximum amount of credit you can get for solar in the state of Utah and all our systems qualify for the maximum credit. Utahgov Checkout Product Detail.

What Is the Federal Tax Credit for Solar Panels. Application fee for RESTC. Take Control of Home Energy Costs Produce Your Own Solar Energy.

Taxpayers wishing to use this tax credit must first apply through the Utah State Energy Program before claiming the tax credit against their Utah state taxes. To claim your federal tax credit you are required to complete IRS Form 5695 when lodging your tax return. Utah Renewable Energy Systems Tax Credit RESTC Utah offers a state solar tax credit in addition to the federal tax incentive.

How does the Utah tax credit for solar panels work. A Secure Online Service from Utahgov. All of our customers qualify for the US.

The tax credit for a residential system is 25 of the purchase and installation costs up to a maximum. Ad Find Out How Much You Would Save With Solar Panels After Federal And State Incentives. And because of the climate it is among the sunniest states in the countrys solar belt.

Ad Find Out How Much You Would Save With Solar Panels After Federal And State Incentives. Everyone in Utah is eligible to take a personal tax credit when installing solar panels. In addition to the state solar tax credit in Utah homeowners may be eligible for the federal solar tax credit.

Calculate What System Size You Need And How Quickly It Will Pay For Itself After Rebates. For Utah solar shoppers state and local tax credits mean theres never been a better time to start exploring solar offerings. In 2023 the tax credits will drop significantly to 22.

Attach TC-40A to your Utah return. Qualifying for the Utah Solar Tax Credit.

Best Solar Panel Installation Companies In Utah July 2022 Forbes Advisor

Does Solar Make Sense In Utah Smart Energy Usa

Giosolar 900w 12v Wind Turbine Generator Solar Panel Kit For Boat 400w Windmill 5pcs 100w Etfe Flexible Solar Panels Monocrystalline 50a Charge Controller Cables Connector

Understanding The Utah Solar Tax Credit Ion Solar

Understanding The Utah Solar Tax Credit Ion Solar

Utah Solar Incentives Creative Energies Solar

In Its Quest To Save Energy And To Pave A Path For Sustainable Development Punjab Has Been Expanding Its Solar Power Generat Solar Power Diy Solar Solar Power

New Solar Export Credits In Utah What The Changes Mean For Installers Aurora Solar

Utah Red Hills Renewable Park Solar Power Facility Parowan Utah

Understanding The Utah Solar Tax Credit Ion Solar

Dominion Offloads Stake In California Utah Solar

Solar Incentives In Utah Utah Energy Hub

Renewable Energy The Best Things In Life Are Free Kem C Gardner Policy Institute

New Solar Export Credits In Utah What The Changes Mean For Installers Aurora Solar

After 10 Years This Utah Alternative Energy Tax Credit Has Yet To Pay Out Any Money